(80G) and 12AAA compliant

vision of where corporate, creative &

Drishty Foundation has been started and operated by Drishty Chhabra Bhasin which is independantly as well as using charitable donations from individuals and Corporates running a charity for the education, employment, empowerment for underprivileged female children alongside Sabaariya Kaur.

Corporate Feudalism by Jasjeev Sukhvinder Singh Bhasin

a political and or economic system whereby corporations replace or coopt governments in running countries.

• Education• Employment • Empowerment

How Does Deduction Under Section 80G

Benefits for Buyers of Sabaariya Kaur Brand(s) can make payments via a Donation to Drishty Foundation instead of paying to a company and avoiding paying GST by receiving a donation slip which can be used for reducing their tax liability (individual or corporate)

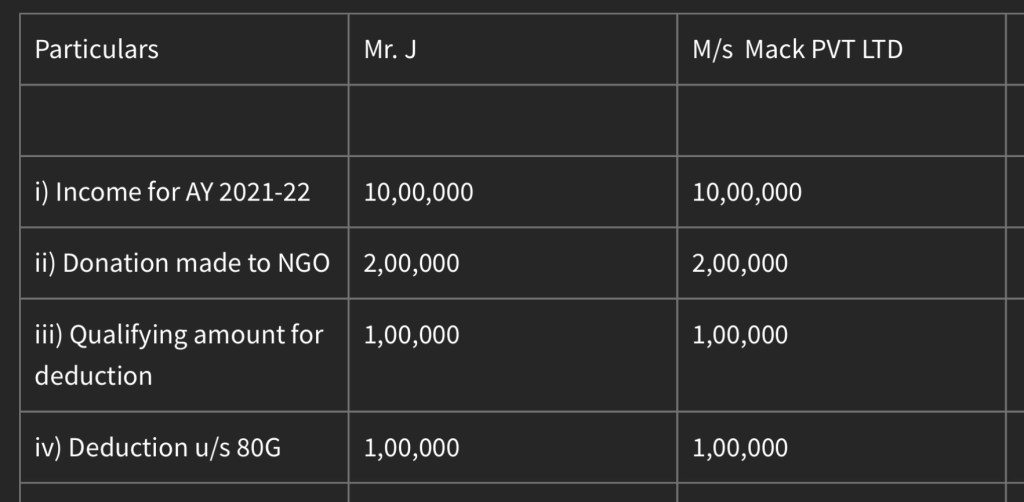

The tax benefit for Mr. J and M/s. Mack Pvt. Ltd. will depend on their applicable tax rates. Let’s consider a different example with the following details:

Mr. J is an individual and M/s. Mack Pvt. Ltd., a company, donates Rs 2,00,000 to a charitable organization. The total income for the assessment year 2021-22 (AY 2021-22) of both Mr. J and M/s. Mack Pvt. Ltd. is Rs 10,00,000. The tax benefit is as shown in the table:

Particulars:

- Mr. J & M/s. Mack Pvt. Ltd.

- i) Income for the financial year 2021-22 10,00,000 10,00,000

- ii) Donation made to NGO 2,00,000 2,00,000

- iii) Qualifying amount for deduction (50% of the donation made) 1,00,000 1,00,000

- iv) Amount of deduction u/s 80G (gross qualifying amount subject to a maximum limit of 10% of the gross total income) 1,00,000 1,00,000

- v) Taxable income after deduction 9,00,000 9,00,000 A. Tax payable after considering the donation

- Mr. J’s tax was calculated as per the income tax slab rate

- M/s. Mack Pvt Ltd.’s tax calculated at 30% 1,32,500 5,40,000 B. Tax payable before donation 1,50,000 6,00,000 C. Tax Benefit from Section 80G deduction 17,500 60,000

Here is the revised table showcasing the tax benefit for Mr. J and M/s. Mack Pvt. Ltd. based on the given details:

As we very well can see the significant benefit of donating through a Corporation more than donating as an individual.

What Are the Tax Deductions Under 80G?

Taxpayers are eligible for an exemption under 80G if they comply with certain specifications regarding the mode of payment, percentage eligible for a deduction, and so on. Here’s a quick look at those criteria that make individuals eligible for a tax 80TTB deduction

- Payment Mode

All contributions made to charitable institutions must be through cheques or demand drafts. In the case of a cash contribution, the amount donated must be below ₹10,000 to be eligible for a tax deduction. Any contributions, like clothes, gift items, or food, cannot claim as a donation for tax exemption.

- Percentage of Contribution Eligible for Deductions

Not all funds come under the 80G category, and only donations to individual funds receive a 100% tax exemption for the amount paid. The others are eligible for a 50% tax exemption. Additionally, any donations made to a trust or NGO that do not have an 80G certification are not eligible for tax exemption

To understand our Concept of Corporate Feudilism, we assume the tax benefit is 50% to the corporate which chooses to donate to Drishty Foundation (a charitable trust under 80G).

Using the 100% donation i.e 2,00,000 made by M/s Mack Pvt Ltd to Drishty Foundation.

Qualitfying amount of tax deduction is 50% of 2,00,000 which is 1,00,000. With a direct benefit of tax deduction after donation is 60,000 as seen in the above table.

Indirect Benefit Donation :

At Drishty Foundation, we work cohesively with Education Institutions (online &/or Offline) for Vocational Training of that particular skill-set needed in the corporation’s Industry.

For Example, an employee who would need vocational training in Diploma in Mechanical Engineering, would be given course membership at our partner institutes which focus on Engineering Courses. The Courses which to the market come at 100% would be offered to the employee at 50% after we directly deposit the 1,00,000 (50% of 2,00,000) which was not tax deductible in lieu of Increasing the Skill Set and Educational Qualification of the Employee Base of M/s Mack Pvt Ltd.

Now let’s assume the Mechanical Engineering course costs each individual 10,000. M/s Mack Pvt Ltd could enroll 10 of its employees or employee’s immediate family for the course and enjoy indirect benefits of skill development for their current & future workforce.

Education Institutions would benefit as they get to count this deduction of Course Fee by 50% without actually losing revenue of 50% since the gap is bridged by Drishty Foundation. Also, this helps them achieve their Corporate Social Responsibility by utilizing donations made to an approved association or institution undertaking rural development programs, as approved under Section 35CCA.

Corporations benefit as 50% of their donation is tax deductible and 50% goes towards vocational training efforts of their corporate hierarchy.

Drishty Foundation would earn through ttansparent Mediums such as revenue earned through

(i) memberships (corporations & institutions)

(ii) sale of tickets to charitable events/galas organized by Drishty Foundation.

(iii) a direct service fee to both employers & institutions for the services provided by Drishty Foundation.

Conclusively, we achieve the Trinity which is using Corporate Donations to Educational Institutions via Social Service Mediators to achieve greater welfare within our communities.

Mode of Payment for Claiming Deduction Under Section 80G

Donations can be made through cheque, draft, or cash.

However, it’s important to note that cash donations exceeding Rs 2,000 are not eligible for deductions. The entire amount donated or contributed is eligible for a deduction of 100%.

In order to get in touch to help make Trinity Project a reality, get in touch with us :

Mobile : +91 9930111823